![]()

It is recorded as a liability because the company still has an outstanding obligation to provide these goods or services. Deferred https://www.bookstime.com/ revenue is recorded as such because it’s money that hasn’t yet been earned. The accountant records the amount as a debit entry to the cash and cash equivalent account and as a credit entry to the deferred revenue account when payment is received in advance for a service or product. A debit entry for the amount paid is entered into the deferred revenue account and a credit revenue is entered into sales revenue when the service or product is delivered. Service revenue is usually classified as either debit or credit, depending on how it’s recorded. The most common type of service revenue is revenue received in advance for future services to be performed.

Unearned Revenue: Decoding Its Significance in Business Accounting

- Your business needs to record unearned revenue to account for the money it’s received but not yet earned.

- It illustrates that though the company has received cash for its services, the earnings are on credit—a prepayment for future delivery of products or services.

- A company should clearly disclose unearned revenue within its financial statements, typically as a part of the balance sheet.

- Accrual accounting records revenue for products or services that have been delivered before payment has been received.

- Represents the impact of fair value adjustments to acquired unearned revenue relating to services billed by an acquired company prior to our acquisition of that company.

- The person receives the money from one party for which the goods have been delivered, or the services have been rendered to the party.

If the company failed to deliver, it would still owe that money to the customer so it cannot be recorded as revenue just yet. In accrual accounting, the revenue https://www.facebook.com/BooksTimeInc/ is recorded as a liability and then credited or debited between accounts as necessary over time. Let’s take a look at the lifecycle of one $5,000 advanced payment. Also, the United States Securities and Exchange Commission has reporting requirements for businesses that are specific to revenue recognition. Revenue recognition is a generally accepted accounting principle that dictates how revenue is accounted for.

- Until then, the company should not recognize the revenue even if it has received the amount against it.

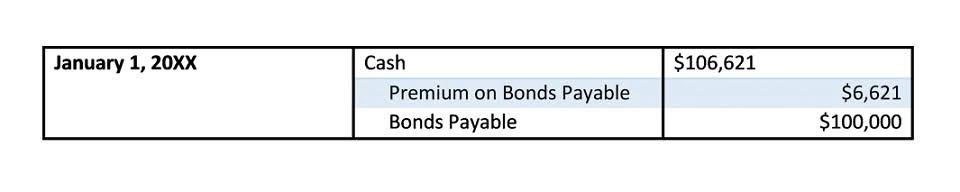

- The initial journal entry will be a debit to the cash account and credit to the unearned revenue account.

- This is the opposite of deferred revenue in a way, that records revenue for services or products yet to be delivered.

- The penalties for removing unearned cash from an IOLTA account can be harsh—sometimes even leading to disbarment.

- This method assumes a twelve-monthdenominator in the calculation, which means that we are using thecalculation method based on a 360-day year.

- Smart Dashboards by Baremetrics makes it easy to collect and visualize all of your sales data so that you always know how much cash you have on hand, which clients have paid, and who you still owe services to.

What Type Of Account Is Unearned Revenue?

Some industries also have strict rules around what you’re able to do with deferred revenue. For example, most lawyers are required to deposit unearned fees into an arms-length IOLTA trust account. The penalties for removing unearned cash from an IOLTA account can be harsh—sometimes even leading to disbarment. That’s considered unearned revenue, and there’s a special way to record it. Whether you have earned revenue but not received the cash or have cash coming in that you have not yet earned, use Baremetrics to monitor your sales data.

How does deferred revenue work under cash and accrual accounting?

Adopting these practices will promote financial stability and growth while maintaining customer satisfaction and trust. Since the actual goods or services haven’t yet been provided, they are considered liabilities, according to Accountingverse. Unearned Service Revenue is a liability account that is used to record advanced collections from clients of a service type business. In other is unearned service revenue a current liability words, it pertains to revenue already collected but the service has not yet been rendered. On the other hand, when these types of revenues are billed after work has been completed, they are usually recorded as a debit to the income statement.

Example of Current Liabilities

Other names used for this liability include unearned income, prepaid revenue, deferred revenue and customers’ deposits. Unearned revenue is the money received by the company or an individual for the service or product that has to be rendered or delivered yet. To stay compliant, entities must record unearned revenue as a liability on the balance sheet. This is done because the company has received payment for a product or service which has not yet been delivered or performed. The liability is reduced as the company fulfills its obligations, and the revenue is recognized in the income statement.

The adjusting entry will always depend upon the method used when the initial entry was made. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month.